The implementation of discounts within the Purchases Journal requires careful consideration of the credit terms agreed upon with suppliers and the potential effects on the company’s financial statements. These cash purchases play a crucial role in managing the inventory levels of the business, as they directly affect the quantity and quality of goods available for sale. They also influence the expense allocation process, as the immediate cash outflow impacts the financial statements. All of the purchase on credit transactions are posted to this journal on an order-by date.

What is the difference between journal entries and adjusting entries?

- This information is necessary to evaluate working capital, liquidity, and inventory turnover while conducting financial analysis.

- HighRadius leverages advanced AI to detect financial anomalies with over 95% accuracy across $10.3T in annual transactions.

- At the end of the month, the list is totaled and the debit and credit journal entry indicated on the bottom line.

- This entry would then be posted to the accounts payable and merchandise inventory accounts both for $2,500.

- Likewise, the company uses one of the two systems to make journal entry for inventory purchase.

If the P or the account number is not there it would mean the information has not been posted yet. There is a description line which gives a brief explanation of the supplier’s name and how it was paid. Notice how the second line (bank)is indented to show that this is the account to be credited. Information from the General Journal is posted into the main ledger known as the General Ledger. An invoice is a document sent by a seller to a buyer, indicating the products, quantities, and agreed prices for goods or services the seller has provided to the buyer. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

Purchase Journal Entry US CPA Questions

Whether you’re recording a straightforward sale or handling complex returns, every accounting entry tells part of your company’s financial story. Mistakes in these entries can lead to inaccurate reports, compliance issues, or missed insights. That’s why understanding the logic behind each debit and credit is essential for every finance professional.

Purchase Journal vs. Cash Book

Not all transactions logged in the purchases journal will result in a debit to the purchases account. Accounting is highly important in business because it allows a company to effectively track purchases and payments made to other vendors, provided that tracking is completed correctly. There are a number of commonly used digital systems for tracking purchases and spending, but in some instances a manual log of accounts may be more appropriate for a company to use.

Balance

Journal entries for purchase credit are recorded in one of the special ledgers, namely the purchase journal. However, now that businesses are leveraging accounting systems to record transactions, the use of special journals is decreasing slowly, and all transactions are recorded in a single place. As mentioned, the company that uses the perpetual inventory system will make the journal entry for merchandise purchased differently from the company that uses the periodic inventory system. Specifically, under the perpetual inventory system, the company will need to record the merchandise purchased in the inventory account or the merchandise inventory account. It is unnecessary to record the credit side of the transaction involving purchases made on purchases journal account.

- It functions as a key component in the ledger recording, ensuring that each transaction is properly documented with the correct date.

- Any transaction entered into the purchases journal involves a credit to the accounts payable account and a debit to the expense or asset account to which a purchase relates.

- This is important to ensure that it presents financial statements that are valid and accurate and have usability as a reference for business people in preparing operational strategies for the next accounting period.

- The purchases journal is exclusively reserved for transactions made on account, meaning the company incurs an Accounts Payable liability.

- The first posting involves the frequent, often daily, transfer of individual line entries to the Accounts Payable Subsidiary Ledger.

When the customer pays the amount owed, (generally accounting using a check), bookkeepers use another shortcut to record its receipt. The cash receipts journal is used to record all receipts of cash (recorded by a debit to Cash). In the preceding example, if Baker Co. paid the $1,450 owed, there would be a debit to Cash for $1,450 and a credit to Accounts Receivable.

What is the difference between adjusting entries and closing entries?

This journal also aids in determining the amounts owed to suppliers, managing accounts payable, and analyzing the company’s purchasing patterns. A purchase credit journal entry is recorded in the company’s purchase journal when buying goods or services on credit from a third party. To record the entry, the company will debit the purchase account, and a credit entry will be recorded under accounts payable. The purchase journal is a basic concept of ACCA Financial Accounting (FA) and Financial Reporting (FR) papers. This allows students to see how for-profit companies make entries for credit acquisits, affecting ledger accounts and both first and final statements. It’s crucial for drafting trial balances, double entry bookkeeping as well as spotting financial discrepancies.

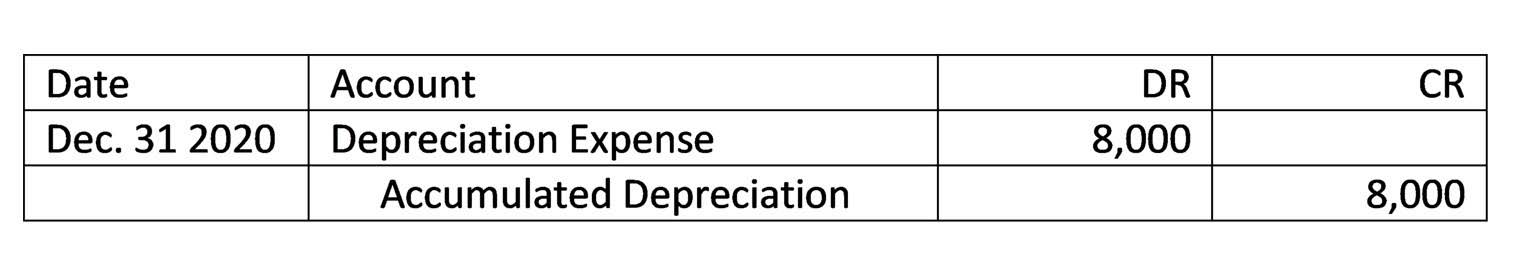

When posting to the accounts payable ledger, a reference to the relevant page of the purchase journal would be included. The purchases journal, sometimes referred to as the purchase day book, is a special journal used to record credit purchases. The purchases journal is simply a chronological list of all the purchase invoices and is used to save time, avoid cluttering the general ledger with too much detail, and to allow for segregation of duties. Adjusting entries are made to ensure revenues and expenses are recorded in the correct accounting period. They update account balances to reflect actual financial activity up to the period’s end.Closing entries, however, are made after the financial statements are prepared.

This journal entry is crucial for https://linhtrangweddingstudio.com/a-complete-guide-on-bulk-payments-and-how-it-can/ maintaining accurate financial records, helping in the management of inventory levels, and ensuring that financial statements accurately reflect the company’s current assets and liabilities. This process holds immense significance as accurate posting to the General Ledger is crucial for maintaining the financial integrity of an organization. It ensures that all transactional data is accurately compiled and organized, allowing for easy tracking and analysis of financial activity. The integrated entries also contribute to the creation of financial statements, enabling stakeholders to make informed decisions based on the company’s financial position and performance.